Introduction

The Hong Kong Equity-Linked Securities (ELS) crisis has become a significant financial debacle, attracting widespread attention and concern. This report delves into the intricacies of the ELS, the roots of the crisis, the primary issues at hand, and the ongoing debates surrounding this financial turmoil.

What is Hong Kong ELS?

Equity-Linked Securities (ELS) are debt instruments with variable payments linked to the performance of a particular equity market benchmark, such as the Hang Seng China Enterprises Index (HSCEI) in this case. These securities are designed to offer returns based on the movements of the underlying stocks, thereby blending the characteristics of both fixed income and equity investments.

The Genesis of the Crisis

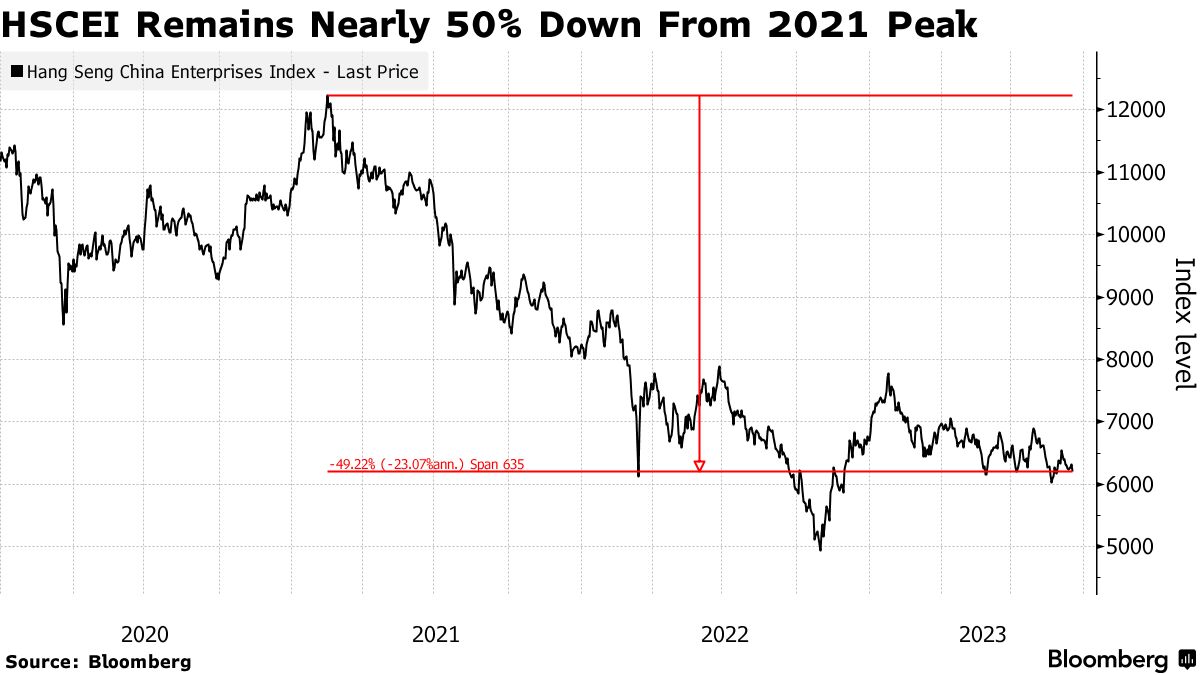

The crisis primarily stems from the significant plunge in the HSCEI, to which the troubled ELS products were linked. The HSCEI's value dropped to half of its 2021 peak, leading to potential substantial losses for investors. Financial institutions in Korea, including major banks like KB Kookmin Bank, have been implicated for selling these high-risk products, with the total sales balance of HSCEI-linked ELS standing at a staggering 19.3 trillion won as of November.

Core Issues

The principal issue revolves around the allegation that investors were not adequately informed about the risks associated with the volatility of the HSCEI. There's a growing concern over the mis-selling of these products, with claims that financial institutions pursued higher commission profits without duly considering the inherent risks or informing their clients accordingly. This situation has been exacerbated by the HSCEI's unexpected downturn, resulting in increased potential losses for the investors.

Controversies and Debates

One of the central points of contention is the suitability of these ELS products for the average investor, particularly the elderly, who may not fully comprehend the associated risks. Financial Supervisory Service (FSS) investigations are underway to determine if there was any mis-selling involved in these transactions. Moreover, there's a debate over the compensation standards, with a push for equal compensation for all investors, regardless of their prior investment experience or knowledge. This demand stems from the perception that distinguishing between investors in terms of compensation could amount to discrimination.

Conclusion

The Hong Kong ELS crisis has unfolded as a complex financial scandal involving substantial potential losses, regulatory scrutiny, and a heated debate over investor rights and corporate responsibility. With financial watchdogs expanding probes and considering compensation plans, the outcome of this crisis will likely have far-reaching implications for the financial industry's regulatory landscape and the protection of investors. The situation underscores the critical importance of transparency, adequate risk disclosure, and the adherence to the principle of suitability in the sale of complex financial products.

This unfolding crisis is a stark reminder of the risks associated with complex financial instruments and the need for rigorous regulatory oversight to protect investors from potential mis-selling and ensure that financial institutions uphold the highest standards of ethical conduct.

'금융정보' 카테고리의 다른 글

| 2024.9.9 기준 인공지능 주가 예측(상승률순) (5) | 2024.09.07 |

|---|---|

| 한국 주식 시장의 한계 (0) | 2024.02.20 |

| 2024.2.13 기관+외인 매수 증가 시작 (1) | 2024.02.09 |

| 2024.2.13 눌림목 세력주 (20일선, 5일선, 60일선 이평선) (0) | 2024.02.09 |

| 코리아 디스카운트: 장기적 저평가의 뿌리깊은 원인들 (0) | 2024.02.03 |